Serena Copley, Liberal for Kiama. Click here to learn more.

BUDGET IN REPLY

I stand on Gadigal land and acknowledge the traditional owners of all the lands of our various electorates.

Mr Speaker

This is a Budget written in red ink.

A Budget of debt, not discipline.

A Budget of vagaries, not vision.

A Budget that’s about papering over the cracks rather than building for the long-term.

A Budget putting band-aids on the major problems faced by the State, like housing, cost of living, infrastructure and health.

A Budget that will be forgotten, even if the costs, the waste and the missed opportunities that it presents lingers long after it’s passed this Parliament.

And a Budget which, after two years in office, shows the mettle of this government.

A government sleepwalking through its term, already out of steam.

A government more focused on spin and self-congratulation than results, while everyday people see this state go backwards.

A government that disclaims and even ridicules vision - but can’t even at least be competent.

Because of Labor’s failures and incompetence:

- Cost of living is soaring — with no new support for families.

- NSW businesses are closing at record rates.

- Housing supply is falling short — with Labor delivering only half the number of homes the Coalition did for every unit of population growth.

- Commuters are spending longer trying to get home from work.

- Strikes and service disruptions are a regular occurrence.

- And thousands and thousands of elective surgery patients are waiting longer than recommended clinically for care.

I’ll turn now to examine this government’s lack of vision, then its incompetence, and then provide some initial suggestions for positive change.

NO VISION

This is a government with a vision and ambition bypass.

There are no new major infrastructure projects. The pipeline left by the former Liberals and Nationals Government is running dry.

That government was transformational, the most successful state government NSW has ever seen.

A government that:

- repaired the economy and paid back debt;

- that transformed Sydney with the biggest road and transport program in its history, including WestConnex, NorthConnex, the first Sydney Metro line - and spearheaded the construction of the Western Sydney International Airport;

- transformed the culture of government through Service NSW;

- completed more than 180 hospitals and health facilities across NSW, and left more than 130 projects underway; and

- delivered 213 new and upgraded schools, with a further commitment of 106 schools projects underway – the largest school building program in NSW’s history.

Labor has no plan to replace the pipeline of projects that have underpinned job creation, economic growth and service delivery across the state.

Instead under Labor, there’s a whopping cut in public infrastructure investment as a share of the economy - about 30% over five years.

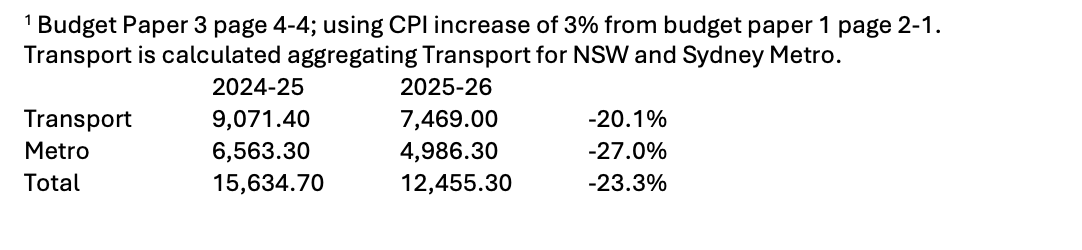

In this year alone, budgeted capital expenditure will be cut in real terms across key portfolios compared with the 2024-25 budget[1]:

- Transport down 23%.

- Health down 4.5%.

- Education down 7.7%.

Let’s take an example. The Aerotropolis Sector Plan contains the appalling revelation that the government had no plans to commence construction, let alone finish construction, of new metros to or from Bradfield before 2040.

It's clear that this government has no plans to commence construction of any new metros or motorways anywhere in NSW before that time.

In recent weeks, the Government has made a big song and dance about four new or upgraded schools in Western Sydney.

In reality, only one of those hadn’t already been announced. That’s in stark contrast to the 23 new or upgraded schools in Western Sydney announced by the Coalition in 2022.

This is a government so scared of ambition that it’s taken to ridiculing it.

This is a government that condemns our transformational infrastructure mega-projects as “vanity projects”.

Only a government so dizzy from its own spin would regard projects like the Sydney Metro or WestConnex as anything other than city-shaping.

It confirms what we all know.

This government has all the vision of a committee trying to redesign a roundabout.

This government is so pointless it regards any project with a lasting impact as a personal threat.

NO COMPETENCE

So I say to those opposite, if you won't be visionary, can’t you at least be competent?

But sadly the government fails that test across the board:

- It’s presiding over rapidly growing debt.

- It will never deliver a budget surplus.

- It’s failed to improve the productivity of the public sector.

- And as a result, it’s failed to ease the tax burden; it’s failed to maintain services, including health, and it’s failed to offer any additional cost of living support.

- And critically, it’s making the housing crisis worse.

RAPIDLY RISING DEBT

This is a government investing less in the future — while letting debt spiral.

And it’s ordinary families who are paying the price.

While the Government is building less, it’s borrowing more.

On its own figures, gross debt is set to rise by 29% over five years[2]; and net debt by 43%[3].

The gross debt is projected to reach $199.7 billion in the final year of the forward estimates.

Annual interest repayments will reach $9.5 billion in 2028-29[4], up from a projected $6 billion in the last Coalition budget in 2022-23[5].

Every household in NSW will have to pay an extra $2,250 a year[6] in state taxes and charges, just so Labor can pay the interest on its debt.

This will be paid by taxes on the family home – stamp duty and land tax – or taxes on jobs – payroll tax. They won’t get better services for this; they will just service the debt.

And it’s not because revenue is lacking — quite the opposite.

NEVER A BUDGET SURPLUS

So that’s how bad it is if you accept the Government’s own figures, including its razor thin surplus of just $1.1 billion in 2027-28.

But the truth is worse, because the Minns Labor Government will never, never deliver a budget surplus.

There are plenty of reasons to call out the forecast surplus for what it is - a fairytale.

First, the budget projections of future general operating expenses just aren’t credible.

Put aside for one moment employee and related expenses, interest, depreciation and amortisation. That leaves what the budget papers call “other operating expenses” and “grants, subsidies and other transfers”.

They account for over $52 billion in 2025-26, or 42% of total expenses.

The Government has budgeted for other operating expenses going up just 1.2% over the next four years and grants, subsidies and other transfers going down 2.4% over the same period[7].

These forecasts are fanciful, when CPI is expected to go up 10.5% over the same period[8].

If these expenses increase merely by one fifth of CPI, that wipes out the surplus. If they increased by CPI, that adds around $5.5 billion in annual expenses by 2028-29.

Second, the 2025-26 Budget makes no provision for potential wage rises above the Government’s offer, arising from arbitration decisions of the Industrial Relations Commission in relation to firefighters, psychiatrists, staff specialist doctors and nurses.

Third, there is no allowance for toll relief beyond the 1st of January, if there ever is to be any toll relief.

Fourth, the Budget papers’ revenue reconciliation with the 2024-25 half-yearly review show a miraculous additional $4.85 billion in revenue in 2027-28.

This includes $1.8 billion more in federation funding agreements[9]. All this is without any meaningful reform or productivity improvements.

And fifth, there is the Government’s failure to date to meet its own forecasts.

To put a supposed $1.1 billion surplus in 2027-28 into perspective, let’s compare that forecast with what’s happened in the last 12 months.

There’s now a revised $5.7 billion deficit for 2024-25, a blow out from around $5 billion expected six months ago and $3.6 billion budgeted 12 months ago – a blow out of around $2.1 billion in just a year.

And, finally, we can confidently predict that the Government will add more expenditure in an election year.

PRODUCTIVITY OF THE PUBLIC SECTOR

This litany of debt and deficit is not because of any shortage of revenue.

Over the next four years:

Payroll tax revenue is forecast to grow by 24%[10].

Transfer duty by 22%[11].

Total state tax revenue by 23%[12].

GST by 14%[13].

This government is collecting record and rapidly increasing taxes, but still can’t - and never will - deliver a surplus or reduce the debt.

This is due in large part to its broken promise and incompetence in dealing with public sector productivity.

At the election it promised significant public sector wage increases, but there would be zero cost to the budget because they would all be funded from productivity offsets.

Instead the government has largely failed to find any productivity offsets.

And as a result, it’s failed to ease the tax burden; it’s failed to maintain services, including health, and it’s failed to offer any additional cost of living relief.

FAILURE TO EASE THE TAX BURDEN

The government offers no tax relief in this budget.

Last year it abandoned indexation of the land tax threshold.

Stamp duty thresholds remain unchanged notwithstanding rising property prices.

Payroll tax thresholds and rates remain unchanged, penalising hard working small businesses in particular.

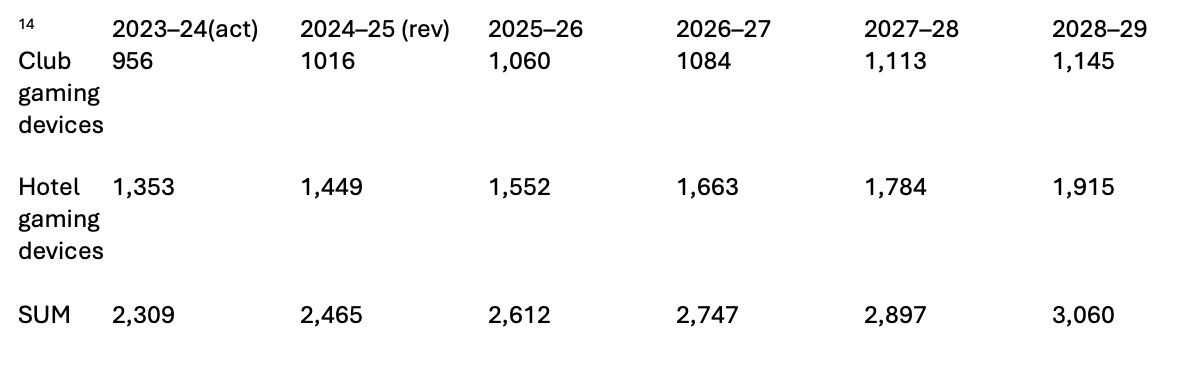

This government remains addicted to gaming machine revenue. Gaming machine revenue from clubs and hotels will be $2.6 billion in 2025-26, forecast to rise to over $3 billion by 2028-29.

This will be a 31% increase over five years since 2023-24[14]. And much or most of this revenue is coming from problem gamblers.

The ongoing significant increases in gaming tax revenue sadly suggest that the government has no plans to tackle problem gambling.

FAILURE TO MAINTAIN SERVICES – HEALTH

On health, Labor promised better care but has instead cut budgets during their tenure, picked fights with doctors, nurses and midwives and let surgery wait-times skyrocket.

AMA (NSW) President Dr Kathryn Austin has lamented:

“There is little meaningful funding in today’s NSW Budget for the state’s ailing public health system and the thousands of patients waiting for their life-saving treatment or surgery. Doctors on the frontline are grappling with more acutely unwell patients with increasingly complex healthcare needs and the funding provided in this budget fails to address that.”

According to the Bureau of Health Information:

- Performance across our hospitals is deteriorating.

- Emergency departments are under pressure.

- Elective wait times are increasing. And more patients are leaving hospitals without being treated at all — because the wait is simply too long.

The latest BHI quarterly report shows that over 100,000 patients are waiting for elective surgery – close to the record set during the pandemic when all elective surgery was cancelled.

Over 8,500 people were waiting longer than clinically recommended – up 151% on the same quarter last year.

And as Dr Austin notes:

“These people are our mothers, our fathers, our colleagues, our neighbours - all in need of surgery to alleviate chronic pain or regain quality of life and independence.”

These aren’t abstract figures. These are real people in real distress.

This Budget delivers no reform, won’t reduce wait times, and does not do anything to prevent people ending up in hospital in the first place.

MENTAL HEALTH

The Mental Health Coordinating Council says of the budget that “The NSW Government has once again failed to deliver the critical investment needed for community-managed mental health services, leaving people with complex mental health challenges without the care and support they need.”

And while services go unfunded, psychiatrists in our public health system are resigning in en mass — another warning sign that this system is under immense strain.

This Budget is a reminder that without competent economic management, you can’t invest in the services that matter.

FAILURE TO MAINTAIN OTHER SERVICES

And outside health there are plenty of other examples of the government failing to provide the services our communities need.

OUR REGIONS

For example, the Budget delivers another brutal blow to regional NSW.

More than a month on from the devastating floods on the North-Coast, Mid-North and Hunter regions – the budget doesn’t include any further funding for category D level grants for primary producers and small businesses.

Communities like Taree and Kempsey are literally on their knees right now pleading for help. It’s at the point where business owners and farmers are rallying in the streets, yet there is nothing set aside to support up to $75,000 – which they desperately need.

There is no clear plan for youth justice reform. No funding for diversion programs. No extra commitment to therapeutic models that are urgently needed, particularly in regional communities.

The Government offers not a single new or upgraded school outside Sydney, and no meaningful investment in water security.

It’s never been clearer that this Government does not understand — and does not prioritise the regions.

WOMEN

The standalone Women’s Budget Statement has been scrapped.

What was once an 80-page policy centrepiece under the former Liberals and Nationals has been reduced to a 20-page chapter buried at the back of Budget Paper 2.

This Budget delivers no new investment in specialist domestic violence services.

And the Minns Labor Government’s cruel cuts to the IVF rebate program were a blow for thousands of women and couples struggling to start a family and a significant step backwards for reproductive health in NSW.

Women’s policy has been sidelined by this Government.

COST OF LIVING SUPPORT

And despite record and rapidly increasing tax revenue, and a cost of living crisis, the Government has offered no new cost of living relief.

Instead, they’ve taken support away — axing or slashing Active Kids, Creative Kids, First Lap, Back to School, regional seniors travel card, regional apprentice travel card.

Zero funding in the Budget to provide toll relief beyond 1 January next year. Absolutely zero.

The Government is set to cancel over $100 million in cost-of-living support next week — on the 30th of June — if eligible households haven’t claimed it by then.

The government needs to come clean on what its plans are for toll relief.

THE HOUSING CRISIS

And, of course, you can’t talk about a cost-of-living without talking about the housing crisis.

Soaring rents and government-imposed taxes on new homes are pushing families to the brink.

Whether you’re trying to buy your first home, keep a roof over your head, or find a place to raise your family — housing costs are at the heart of the cost-of-living crisis.

This Government promised to fix the housing crisis, but it’s making it worse.

Their own Budget finally admits that they won’t meet their commitment under the National Housing Accord. Their five-year forecast is just 240,000 new homes[15] — 137,000 short of their commitment.

Under this Government we’ve seen housing approvals, commencements, and completions drop to the lowest level in a decade; construction costs soar, and no infrastructure plan to support new homes.

State Government taxes and charges on new homes are the highest in the country and the highest on record.

They’re crippling financial feasibility and new housing supply, making it harder to build, more expensive to buy — and they still can’t explain what their $12,000 tax, their so-called Housing and Productivity Contribution, will deliver.

The 5,000 homes that the Government is proposing to underwrite with its pre-sale guarantee initiative is just 1.3% of its housing target and is a concession that their taxes and charges are killing feasibility in the housing sector.

Two years on, Labor is pretending to fix a problem it created.

It’s released a draft guideline allowing developers to deliver infrastructure instead of paying the Housing and Productivity Contribution in cash — but the total cost remains unchanged.

Instead of fixing the problem, Labor is begging the private sector to do the Government’s job — building basic infrastructure like roads and schools — while families are left footing the bill.

Labor’s housing policy is heavy on announcements but light on delivery — and it’s making the crisis worse.

Housing supply doesn’t exist in a vacuum.

It depends on the right infrastructure being in place — roads, rail, schools, hospitals and public services that make new homes more liveable and connected.

You just can’t approve housing targets without a plan to support the people who will live there.

And while the Government claims to prioritise housing, it’s failing to provide the basic infrastructure required to support it.

It’s disclaimed mega projects it says it will concentrate on neighbourhoods, it’s not even delivering infrastructure there.

LACK OF ACCOUNTABILITY

In the Appropriation Bill, the Treasurer has allocated nearly $850 million to a fund so broadly defined that it could be used for almost anything.

If the Government has specific plans for this money, the public deserves to know.

The purpose of a Budget is to provide a clear breakdown of how taxpayer funds will be spent in the year ahead.

Setting aside nearly $850 million without transparency or clear purpose raises serious concerns.

It suggests either that the Government doesn’t know what it intends to spend the money on, or worse, that it intends to give itself a blank cheque—spending taxpayer funds at its discretion with minimal oversight.

PROPOSALS FOR CHANGE

So what would the Coalition do?

Mr Speaker, over the coming 21 months NSW will hear our detailed policies and plans to give the people of NSW what they deserve:

- Better infrastructure - in both our cities and regions.

- Healthier communities served by the world’s best hospitals.

- A housing plan that invests in essential infrastructure, delivers meaningful tax reform, supports first home buyers, and provides incentives to get homes built.

- A justice system that keeps communities safe and puts offenders on the right track.

- A cleaner environment - the most enduring legacy we can leave our children.

- An education that equips our children for the second half of the 21st century.

- An economy that’s productive, competitive and strong, which supports small business and innovation.

- A State that’s just, prosperous and fair.

- And a State where every family can afford to live, raise children, and access the services they need.

TRANSFORMATION

The next Coalition Government will be a transformational government.

The challenges of 2027 will be very different from those of 2011 — and in many ways, even greater.

We must be ready for them, providing a clear pathway to future success and wellbeing of today’s young generations.

Because ahead of us lies a world of profound risk but unprecedented opportunity:

- A world where truth is harder to discern, and misinformation spreads faster than ever.

- A world of rapid technological change, bringing both immense potential and complex new threats.

- A world where governments must respond to more frequent and extreme climate change events.

- A world of geopolitical volatility.

- A world where debt is more expensive, and every dollar must be stretched further.

- And a world where the cost of living is rising faster than many families can afford.

But in the meantime, here are some ideas for starters.

HOUSING

First, housing.

We maintain our commitment to work constructively with the government to attempt bipartisan reform of the planning system.

We advocate restoring the First Home Buyer Choice program — removing the burden of stamp duty for young people trying to get into the market.

As we've previously announced, we’d:

- exempt eligible older Australians downsizing from paying stamp duty, freeing up larger homes for families.

- launch a multibillion dollar council housing incentives program, properly funded, unlike the token $200 million gesture from Labor.

- cut the taxes and red tape that are making new developments unviable.

For example, we’d pause the Housing and Productivity Contribution for the life of the National Housing Accord and after that defer its collection from the construction certificate stage to the occupation certificate stage.

Affordability starts with supply, and supply starts with a government that gets out of the way — not one that stacks on more costs.

COST OF LIVING

Second, cost of living.

A Coalition Government would do more to ease the pressure on everyday expenses for households across NSW.

In the meantime we call on the Government to reinstate the full Active Kids program, not only to help with household budgets, but to get our kids moving, learning and engaging again.

We call on the Government to extend the toll relief deadline beyond 30 June and come clean on what it’s actually doing about toll relief going forward.

SMALL BUSINESS

Third, small business.

We’d consider fairer payroll tax settings to support small and medium-sized businesses across NSW — to ease the pressure on employers, protect local jobs, and keep prices down for consumers, to give businesses the breathing room they need to grow, invest, and to hire — especially in regional and suburban communities that are doing it toughest.

AI AND INNOVATION

Fourth, artificial intelligence.

The Government’s budget papers specifically note that “in the absence of meaningful reforms or a major technological breakthrough, low productivity growth will continue.”

Yet, the Treasurer has provided no meaningful answer to this fundamental problem.

A Coalition Government would embrace, embed responsible artificial intelligence across public service processes to improve services and free up teachers, healthcare professionals and public servants to engage directly with people and problems, instead of being tied up with unnecessary administrative burdens.

This work would be preceded by the development of an AI Opportunities Action Plan[16], as in the UK, overseen by a dedicated Minister for Artificial Intelligence.

For small and medium business owners looking to get ahead using AI, a Coalition government would set up AI4Biz, a zero/low-interest loan scheme for small and medium businesses looking to introduce responsible AI into their business operations.

HEALTH AND WELLBEING

Fifth, health and wellbeing.

New approaches to managing chronic illness are improving lives and saving public dollars. A forward-thinking government should seize these opportunities — and that’s exactly what we’d do.

Because a healthy NSW is a happy NSW. And a healthy NSW is a productive NSW.

A Coaliton Government will make genuine investments in preventative health so that people can live better, longer lives.

The Special Commission of Inquiry into Healthcare Funding told us something confronting: that over 84,000 hospitalisations in a single year could have been avoided with better preventative care.

So we’d:

- Improve nutrition support for older patients.

- Set up preventative health hubs in high-risk communities, including indigenous and multicultural communities.

- Expand telehealth services so everyone, no matter where they live, can get quick advice, particularly in regional communities.

- And secure funding for urgent care centres to ease the load on emergency departments.

Our health system needs proper planning, proper funding and practical reform — not press releases and shortfalls.

We’ll take a different approach to this government. We’ll prioritise emergency care, protect frontline services, and reinvesting in critical areas that its neglected.

Because health isn’t just a line item in a budget — it’s the foundation of our wellbeing and the core responsibility of government.

BUDGET RESPONSIBILITY

And sixth, budget responsibility.

Strong financial management is part of our DNA.

We’ll live within our means.

We’ll aim to operate balanced budgets over the economic cycle.

We won’t take the lazy road of higher taxes, as Labor in general and this Government in particular have done again and again.

And we’ll grow the economy.

We’ll create the conditions for new jobs, new businesses, and new opportunities to thrive.

CONCLUSION

Mr Speaker NSW deserves better than a government that’s sleepwalking through the crises confronting the people of NSW.

A government that delivers transformation.

A government that’s responsible and competent.

A government focused on building a stronger economy which every citizen can benefit from.

A government focused on the opportunities and the challenges of tomorrow.

That’s the kind of government the Liberals and Nationals team will be.That’s the kind of government the Liberals and Nationals team will be.

And that’s what we’ll be offering the people of NSW.

[2] Budget paper 1 pages 1-6, 8-4

[3] Budget paper 1 page 8-4

[4] Budget paper 1 page E-10

[5] 2022-23 Budget paper 1 page 5-8

[6] Total debt is projected to reach $199.68 billion by 2028-29. Annual interest bill on debt will reach $9.5 billion by 2028-29. There are approx. 3.364 million households in NSW. Divide the total interest bill by number of households = $2823 per household.

[7] Budget Paper 1 page 7-7

[8] Budget Paper 1 page 2-1

[9] Budget Paper 1 page 5-2

[10] Budget paper 1 page 5-5

[11] Budget paper 1 page 5-5

[12] Budget paper 1 page 5-5

[13] Budget paper 1 page 5-9

[15] Budget Paper 1 page 2-9